Grow and Manage Your Business From One Screen

Want to know more? Fill out the form below.

Website Header Form

The Struggle is Real

Avoid headaches with our business software and tools

Payment Hassles

Marketing Struggles

Contact Chaos

Appointment Headaches

Grow Faster and Run Smarter

Our Business Management Platform is built to help small town businesses do their best

Grow Features

- Integrated Lead Conversion Tool

- Business Website Design & Management

- Managed Directory Listings

- Managed Search Engine Optimization

- Managed Social Media Posting

- Targeted Local Display Ads

- Targeted Social Ads

Personal Support

- Dedicated Onboarding Specialist

- Dedicated Relationship Manager

- Regular Scheduled Check Ins

- Unlimited US-Based Support Team

- Unlimited Performance Optimizations

- Monthly Reporting & Insights

- Small Business AI Chat Included

Run Features

- Integrated Communication Inbox

- Integrated Calendar

- Integrated Estimate/Invoice/Billing System

- Cloud-Based CRM

- Automated Email/SMS Communication Platform

- Ecommerce Platform

- Business Domains

- Business Email Management

- Merchant Services

How We Help You Win

Level up with our full suite of business and marketing tools

Website

Responsive websites that look great on every screen

Social Media

Engage with potential and repeat customers and build awareness

Search Engine Optimization

Get found online before your competition does

Monthly Reporting

Watch your business grow month-over-month with regular check-ins

Local Online Listings

Reach your ideal customers and stay on top of your online presence

Reputation Monitoring

Stay ahead of online reviews – both good and bad – across review platforms

Website

Responsive websites that look great on every screen

Social Media

Engage with potential and repeat customers and build awareness

Local Online Listings

Reach your ideal customers and stay on top of your online presence

Search Engine Optimization

Get found online before your competition does

Monthly Reporting

Watch your business grow month-over-month with regular check-ins

Reputation Monitoring

Stay ahead of online reviews – both good and bad – across review platforms

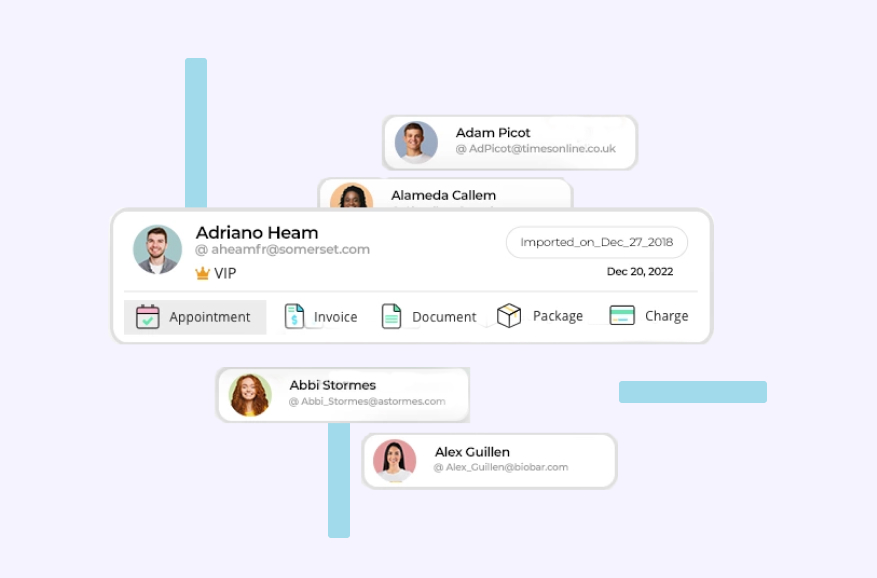

Meet Townsquare App

– your go-to business companion! Simplify your invoicing, scheduling, and billing with our user-friendly software, making customer management simple.

Unleash Your Business Superpowers

All the tools you need to help your business grow, thrive and run smoothly

01

Engage Customers

Build Awareness through Social Posting

Utilize Local Advertising with Display Ads

Harness Social Media using Paid Social Ads

02

Branding & Conversion

Establish Online Presence with Website

Boost Online Visibility with Search Engine Optimization

03

Customer Management

Billing & Invoicing

Book, Schedule, Follow Up

Lead Capture & Customer Management

04

Follow Up & Repeat Business

Email & SMS Marketing

Dedicated Team

Ecommerce & Online Store